Arbitrum vs Optimism

Key Takeaways

- Arbitrum's active fraud proofs safeguard users against the sequencer landing invalid output proposals, such as draining the bridge. With 20 whitelisted validators in place, the execution of any fraudulent transactions is mitigated if at least one validator operates honestly.

- Optimism currently lacks active fraud proofs, posing a significant risk to funds on the rollup. However, fraud proofs through the Cannon upgrade are active on testnet and expected to be implemented soon.

- The primary trust assumption of optimistic rollups is upgradeability. Upgradeability in Arbitrum is controlled by the DAO with a three day delay, or instantaneously by a 9/12 community elected multisig. Optimism upgradeability is controlled by an anonymous member 5/7 multisig.

- Both Arbitrum and Optimism have centralized sequencers that pose a risk of transaction reordering (MEV extraction) and downtime (loss of liveness). If Optimism’s sequencer goes down, funds are frozen. On Arbitrum, after ~7-days, funds in the bridge become retrievable.

- Optimism operates under a permissive MIT license while Arbitrum falls under a commercial BSL that requires a license to fork the codebase.

- Optimism looks to scale through a network of interconnected L2s dubbed the Superchain while Arbitrum looks to scale through L3s dubbed Orbit Chains.

- Arbitrum has more unique active wallets, daily transactions, and revenue driven to its DAO than Optimism.

Arbitrum and Optimism, optimistic rollups based on fraud proof technology, are the reigning kings over the Ethereum scaling landscape today. With over $6 billion in stables and ETH, and over $15 billion in total value secured, Arbitrum and Optimism are not just technical ingenuity but represent a changing paradigm for investability within the Ethereum and greater crypto ecosystem. This report delves into the intricate workings of these rollups, unpacking their potential to redefine the core theses of every crypto investor.

The narrative around rollups has been around for some time, with Vitalik highlighting their potential as early as 2014. However, in 2023 these ecosystems truly began to flourish, marked by significant traction and the launch of the ARB token. Notably, during multiple instances throughout the year, Arbitrum even recorded a higher daily transaction volume than Ethereum mainnet itself.

Introduction to Optimistic Rollups

The Ethereum network frequently experiences congestion when many transactions occur onchain which results in elevated gas fees. This issue became particularly evident in 2021 when simple Uniswap V3 swaps averaged as high as $63 throughout November. For those invested in Ethereum, there is likely an expectation that the number of users on the network increases in the future, which will lead to increased costs of transacting on mainnet. These costs would likely prevent the majority of the world from using the network. The concept that "Ethereum can't scale" has been a notable point of discussion in the crypto community since its early days. Though there have been many ideas at how to solve the problem, today, a rollup centric future is proposed as the solution that will allow Ethereum to scale to billions of users. Optimistic rollups Arbitrum and Optimism currently dominate the landscape in all metrics.

Optimistic rollups enhance throughput and transaction cost savings while, in theory, inheriting Ethereum's security. In essence, any Layer 2 rollup on Ethereum operates by collecting L2 transactions, compiling their data into a single consolidated transaction, and then sending this batched transaction to Ethereum mainnet. The sequencer is an agent responsible for ordering L2 transactions. The sequencer can also be responsible for submitting transactions as a single batched transaction to the L1, though ordering and submitting roles can be separated. Each rollup must have a proof system designed to enable Ethereum to verify the validity of the transactions proposed by the sequencer/batcher. Its purpose is to prevent fraud like double spends and transactions from accounts with insufficient balances. The fundamental principle of optimistic rollups is a default trust assumption, where Ethereum presumes transactions within each batch are valid unless proven otherwise.

Proof Systems

Fraud proofs, also known as fault proofs, are the main component at the core of each optimistic rollup’s proof system securing the environment from the sequencer landing invalid output proposals. An invalid output proposal would be a batched transaction that includes a fraudulent state change, for example, one which tries to withdraw the entirety of the rollup bridge’s value to an address that has only deposited 1 ETH into the bridge.

Following the batched transaction there is a specified “challenge period” in which an L2 validator can facilitate a dispute claiming fraud on behalf of the L2’s users. L2 validator nodes run the same transactions included in the batch against their copy of the L2 state and submit a fraud proof if they detect invalid transactions. Following the submission of a fraud proof, there is a deterministic (smart contract encoded rule based) dispute game which allows the Ethereum network to deduce if the transaction is indeed invalid. The upcoming sections will delve into the nuances and the broader impact of fraud proofs and dispute games in Arbitrum and Optimism.

Arbitrum

Arbitrum currently has an active, albeit permissioned, fraud proof system through its Nitro upgrade. The permissioned aspect stems from the limitation that only 20 whitelisted validators can submit fraud proofs to Ethereum. However, the DAO holds the capability to expand this whitelist by adding more validators. Furthermore, there's a prospective fraud proof system, named BoLD, under consideration. If implemented by the DAO, BoLD would enable Arbitrum to transition towards a permissionless model for fraud proving. As of now, the interactive fraud proofs in Arbitrum's Nitro function as follows:

- A number of transactions are ordered by the sequencer and a compressed representation of the L2 transactions is posted to Ethereum by the batcher. In Arbitrum, the batcher is a separate agent from the sequencer, though both are run by Offchain Labs.

- Arbitrum’s 20 L2 validators run the same transactions against their locally stored copy of L2 state.

- If any of these validators detect fraud within the ~one-week challenge period, they submit a fraud proof to Ethereum mainnet.

The dispute game begins

- A defending validator that believes the transaction is valid splits the transaction’s steps into two distinct halves.

- The fraud proof submitting node challenges one of the batches in which it sees fraud.

- This bisection and challenging process is repeated, progressively narrowing the focus until only a single step remains in dispute.

- The Ethereum mainnet's L1 referee contract then emulates this specific transaction step to ascertain its validity. The outcome is final and is recorded on the Ethereum blockchain.

When a fraud-proof is successfully submitted and validated, it essentially means that the questioned transaction is blocked on mainnet. The L2 state, as recorded by validators operating with integrity, continues to reflect the network's status without the inclusion of this disputed transaction.

Any withdrawal from the Arbitrum canonical bridge has a 7-day delay to ensure that validators can submit fraud proofs and prevent fraudulent activity. If there is a single L2 validator acting with integrity, the rollup remains secure. The main concern with a permissionless validator set is the risk of a delay attack where a malicious validator is able to delay confirmation of transactions on L1 for 7 days by starting a fraud proof game, without fraud being present. In BoLD, whichever validator loses the dispute game gets slashed, which eases this concern.

Arbitrum's BoLD fraud proofs and Optimism's Cannon fraud proofs (which are not yet active on mainnet) have similar operational principles, with minor differences that are generally non consequential to the end user. For example, Arbitrum uses WebAssembly (WASM) to compile state changes for use in its dispute game, whereas Optimism employs MIPS, another assembly language. These languages enable validators to deconstruct a transaction down to its final step, which is then submitted to Ethereum for dispute resolution.

Another nuanced difference lies in how the systems handle potentially malicious sequencers (/batchers). In Optimism Cannon, the sequencer, which is always involved in defending its transactions as a validator, faces penalties for any malicious actions. Conversely, in Arbitrum, if a sequencer tries to submit a fraudulent transaction and all validators agree on its invalidity, the transaction is immediately rejected upon fraud proof submission without entering a dispute phase.

Optimism

Today, Optimism does not have any sort of fraud proofs active in the rollup’s mainnet architecture. Optimism had fraud proofs until late 2021 when they removed them due to vulnerabilities in the system. Since then, the centralized sequencer has maintained the ability to land invalid output proposals, posing significant risks to the rollup and its users. A user with funds on Optimism fully trusts that the sequencer, a role fulfilled by the Optimism Foundation, acts in a truthful manner. In other words, the centralized Optimism sequencer can settle a malicious transaction that removes all ~$2.5B in the bridge to an address of its choosing. Upgradeability of the Optimism contracts functions as the only other backstop against invalid output transactions, which will be discussed in detail in the following section of the report.

For the last two years, the Optimism team has been working on a fraud proof system dubbed Cannon. Cannon went live on Optimism testnet in early October, and after thorough testing, should soon be ready for mainnet deployment. Notably, Cannon will allow for a permissionless validator set for fraud proving. Upon implementation, the rollup’s fraud proofs will theoretically be on par with Arbitrum, but without the battle tested track record of Arbitrum’s proof system.

In theory, a rollup could utilize WASM or MIPS validity proofs as its proof system, meaning that in the future either rollup could potentially transition into a zkRollup. While this space is largely unexplored, Optimism has given two grants for those doing research in this area to O(1) Labs and RISC zero.

Upgradeability

Rollup upgradeability is a feature that allows for modifications to the smart contracts involved in a rollup's operations, such as those in its proof system, sequencer/batcher, or bridge. This is in contrast to immutable smart contracts, which, once deployed, cannot be altered. Both Arbitrum and Optimism incorporate upgradeable systems, giving them the flexibility to integrate new and improved technologies as they emerge. This adaptability is an essential aspect of any L2 for it to remain competitive and evolve alongside advancing technology.

Upgradeability is the central trust assumption in optimistic rollups, and holds significant control over all funds and operations within a rollup. For example, whatever address controls upgradeability of the bridge contract can move all bridged funds to an address of its choosing. Given the 7-day queue for any transaction initiating a withdrawal from the bridge, upgradeability is a more core trust assumption than fraud proofs in optimistic rollups. This is due to the fact that, in a scenario where a sequencer executes an invalid output proposal potentially draining the bridge, the system's ability to upgrade within this 7-day period offers a critical safety mechanism. Essentially, the chain could be upgraded during this window to redirect the funds, serving as a last resort to safeguard assets against such threats.

The control over upgradeability in the Optimism contracts is currently governed by a 5/7 multisig. The identities of the signers on this multisig are not publicly disclosed. This multisig arrangement holds extensive authority over the rollup, including the ability to halt withdrawals, upgrade the bridge, access all funds, and change the sequencer, effectively giving it full control over the rollup's operations.

Recently, there has been a development in the governance of Optimism. The DAO passed a vote to establish a security council. The plan is to transition the power of upgradeability from the anonymous multisig to this security council over time, which will consist of known community members appointed by the Optimism Foundation. This moves toward a more transparent and community-driven governance model, though still leaves quite a bit of room for improvement.

Recently, there has been a development in the governance of Optimism. The DAO passed a vote to establish a security council. The plan is to transition the power of upgradeability from the anonymous multisig to this security council over time, which will consist of known community members appointed by the Optimism Foundation. This moves toward a more transparent and community-driven governance model, though still leaves quite a bit of room for improvement.

Upgradeability over Arbitrum contracts is maintained by the DAO but there is a 12 member multisig that maintains a more fundamental control. Onchain proposals by the DAO pass through a 3-day timelock prior to being executed, whereas the 9/12 security council multisig is able to pass proposals instantly. The members of the council have been elected by the community and can be removed by the DAO. Additionally, they are legally bound by a contract with the Arbitrum Foundation to act in the protocol’s best interest.

The most critical role of the multisigs, which hold overarching authority over Arbitrum and Optimism, is their capacity to act swiftly in the face of vulnerabilities. Should a security issue or vulnerability be detected within these systems, these multisigs are empowered to rapidly implement an upgrade or take necessary actions to address and potentially mitigate the issue. This ability to respond is vital for the protection of the network and its users for the nascent rollups, ensuring that any security concerns are dealt with effectively with minimal delay. Balancing the tradeoff of decisive action with a point of centralization will hopefully continue to be iterated toward true decentralization as the rollups mature.

Sequencer and Proposer

A sequencer is an offchain entity (specialized node) responsible for collecting L2 transactions and ordering them. Today both Arbitrum and Optimism have centralized sequencers run by the teams that created the rollup. The sequencer gives users almost instant soft confirmations for transactions, though finality is only achieved when the transaction has been included in a confirmed block on Ethereum mainnet. In terms of structure, Arbitrum and Optimism differ slightly. Arbitrum technically distinguishes between the roles of the sequencer and the batcher/proposer. In Arbitrum's case, while the sequencer orders the transactions, it's the batcher's job to propose these ordered transactions back to Ethereum mainnet. Despite this separation of roles, both the sequencer and the batcher in Arbitrum are operated by the same team. In Optimism, the sequencer is a single agent also responsible for batching/proposing on L1.

The sequencer/batcher has three critical concerns associated with it:

Censoring transactions (exclusion)

Reordering transactions (MEV)

Downtime (Liveness)

- Cannot post transactions to mainnet

- Entirely down and unable to receive L2 transactions

The concern of transaction censorship in Optimism and Arbitrum is mitigated by their Forced Inclusion mechanisms. This feature allows users to directly submit transactions to the sequencer inbox contract on Ethereum mainnet. Doing so compels the sequencer to include these transactions in a block. Arbitrum and Optimism have different time delays for this process: Arbitrum implements a 24-hour delay for transactions using the forced inclusion function, while Optimism has a 12-hour delay. Forced inclusion and censorship resistance is vital to maintaining the ethos of decentralization and transparency of Ethereum.

Both rollups claim that their sequencers do not engage in reordering transactions to extract MEV and adhere to a first-in, first-out ordering of transactions. While currently, there's no mechanism to independently verify these claims, the rapid transaction inclusion and the reputational risks involved make it likely that this statement is accurate. The rollups' commitment to FIFO ordering and non-extraction of MEV is a significant aspect of their design that can be changed in the future to create a new revenue stream for the DAOs.

In the scenario that the sequencer loses its ability to post transactions to mainnet, which has occurred with Arbitrum, L2 state continues to push forward though the rollup is not able to reach finality. It is debatable whether this can be considered “downtime” and a loss in liveness. If the sequencer regains its ability in a short period of time, there is no significant concern. There was also a short period of time in which Arbitrum lost complete functionality of its sequencer due to a bug and a high amount of transaction demand from ordinal inscriptions, which led to a true downtime and a loss of liveness.

One key distinction between Arbitrum and Optimism is what abilities users have if the agent in charge of proposing blocks back to L1 goes down. On Optimism, there is no recourse for users as only the sequencer can publish back to L1. This means if the sequencer is fully down, users’ funds are stuck. On the other hand, with Arbitrum, if one week passes with no proposed blocks, self propose becomes possible, and any user can take on the role.

Both Optimism and Offchain Labs are working with Espresso for the creation of decentralized sequencers which may be implemented in the future. If the shared sequencer makes it to production, it could allow for interoperability between rollups, helping decrease the liquidity fragmentation that exists today.

Licenses

The difference in licensing models between Optimism and Arbitrum have significant implications for how their open-source codebases can be used and adapted by other teams and projects. Optimism operates under the MIT license, a permissive license allowing anyone to freely fork and adapt its code. This openness has made Optimism attractive for teams looking to create their own L2 rollups. However, the Optimism "Superchain" falls under a commercial license, which imposes restrictions on project’s using its tech such as the requirement that OP govern (control upgradeability) over the rollup.

Arbitrum falls under a Business Source License (BSL,) which requires permission from the DAO, foundation, or Offchain Labs to use the Arbitrum stack. While this approach ensures that value is driven back to the Arbitrum ecosystem by projects using its code, it also means that creating Layer 2s using Arbitrum is not as simple as with Optimism. The creation of Layer 3s, or Orbit chains on top of Arbitrum, can be done in a permissionless manner. Orbit chains settle back to Arbitrum, which ultimately settle back to Ethereum through the aforementioned Arbitrum sequencer.

Optimism's approach has had a notable advantage in attracting rollup teams due to its freedom for developers to maintain full control and customizability over their rollup, but faces the challenge of ensuring that these independent rollups contribute value back to the Optimism ecosystem outside of soft network effects. This situation is exemplified by the BNB Chain's implementation of the Optimism stack, which operates independently of Optimism's influence and does not settle to Ethereum. Conversely, Arbitrum’s approach with the BSL allows the platform to ensure that any rollup using its technology contributes back to Arbitrum, whether through sequencer revenue, the creation of developer tooling, or other means.

Projects like Frame, Parallel, and Kinto have received the Arbitrum license with more teams supposedly in the pipeline. Additionally, there is discussion of a “self service” license, where a team that returns 10% of sequencer revenue to the DAO will have the ability to use the Arbitrum stack freely.

Many teams looking to create rollups have opted to use the OP stack in order to maintain control over the sequencer and value it generates and more customizability over the environment. Projects like Aevo, Lyra, Synapse, Mantle, UniDex, Zora, Base, and more are currently building with the OP stack. Notably, few of these projects fall into the Superchain category outside of Base.

Scaling

Like Ethereum, both Optimism and Arbitrum face throughput limitations solely on their respective rollups. Their strategies for further scaling to larger user bases differ significantly: Arbitrum's Scaling through Layer 3 Orbit chains and Optimism through The Superchain.

Arbitrum's approach to scaling involves the use of Layer 3 execution environments, known as Arbitrum Orbit chains. These L3 networks are designed to settle back to the Arbitrum L2, allowing for additional layers of transaction processing and application-specific customization. Each obit chain retains the ability to govern itself, use any gas token, and choose its data availability layer. Orbit is turnkey compatible with data availability committees (“DACs",) Celestia, or Ethereum. This hierarchical structure enables Arbitrum to offload transactional load to these L3s, thereby scaling effectively, while maintaining Ethereum’s security (assuming the data availability layer is trustworthy.)

Optimism, on the other hand, envisions scaling through the creation of an ecosystem of interconnected L2s, collectively referred to as The Superchain. Governed by the OP token, this ecosystem allows individual rollups to remain customizable while benefiting from shared upgrades and governance. Each rollup within The Superchain can choose to remain part of this interconnected ecosystem or opt to leave, providing a balance between collective advancement and individual autonomy. Optimism chains are also turnkey compatible with Celestia for DA.

Both strategies reflect the ongoing innovation in addressing the scalability challenge. Arbitrum's layering approach with Orbit chains and Optimism's Superchain ecosystem offer different pathways to support a growing number of users while maintaining the security characteristics of Ethereum.

Community

The communities surrounding Arbitrum and Optimism exhibit distinct priorities and approaches, especially evident in how they utilize their substantial treasuries. Optimism, with a treasury valued at approximately $7.4 billion, is predominantly focused on the retroactive funding of public goods. This direction underscores a commitment to supporting projects and initiatives that benefit the wider ecosystem and community, aligning with a broader ethos of collective advancement.

In contrast, Arbitrum, holding a treasury of around $6.4 billion, appears more oriented towards protocol incentives and grants programs. This focus suggests a strategy aimed at encouraging the adoption and development of its platform, possibly through rewards, grants, or other incentives that directly stimulate growth and activity within the Arbitrum rollup. These differing priorities reflect the diverse philosophies and goals within the rollup sector.

Both Arbitrum and Optimism are relatively new DAOs, with Arbitrum launching its token in March of 2023 and Optimism in May of 2022. This early phase in their development implies that both DAOs are likely to evolve, adapt, and further define their strategic directions and priorities in the future. As they continue to grow and respond to a dynamic environment, we can expect to see refinements in their approaches and potentially new initiatives that align with their respective community goals and broader objectives.

Activity

The current usage metrics of Arbitrum and Optimism show that Arbitrum has a higher level of activity on its rollup compared to Optimism. This higher usage is evidenced by a greater number of unique active addresses, a higher volume of daily transactions, and more gas used on Ethereum mainnet. These metrics collectively suggest that, as of now, Arbitrum is experiencing more extensive adoption and engagement within its execution environment.

There is debate in the crypto community regarding the definition of L2 TVL. While some focus on the aggregate value secured across each rollup, there is a contention about whether to count only assets that are canonically bridged into the ecosystem, or to include native assets as well. On the other hand, platforms like DeFiLlama propose a different interpretation, where TVL is quantified as the value locked within DeFi smart contracts on the rollup. This angle highlights the depth of DeFi activities on each rollup, providing a measure of their practical utility. However, this approach might not fully encapsulate the overall growth and standing of these ecosystems in the market. Recognizing this divergence in definitions is vital for a comprehensive ability to compare L2s.

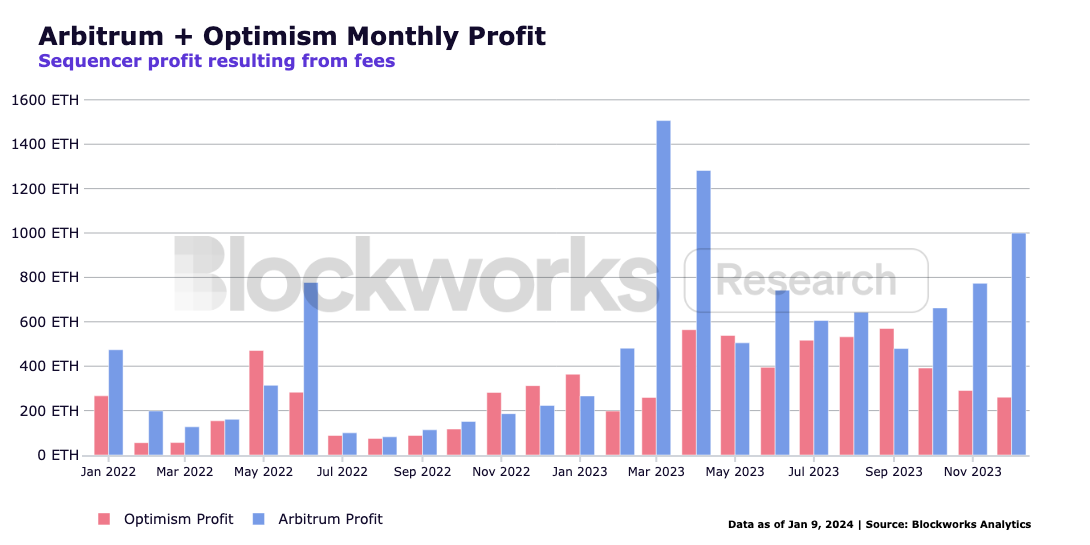

The final, and arguably most important metric, is that of rollup gross profit. This revenue is generated when users transact on an L2, incurring fees that are composed of two main parts: the cost of posting transaction calldata to Ethereum (including a buffer for variability in Ethereum gas prices) and a congestion-based gas fee specific to the L2. Currently, both Optimism and Arbitrum have adopted a gas fee structure similar to Ethereum's EIP-1559, where the fee adjusts dynamically based on network congestion according to a first-price auction.

The difference between the actual cost of posting data to Ethereum and the fee charged to users represents the gross profit for these rollups. A key aspect of this revenue model is that it contributes ETH to the respective DAO treasuries. Comparing the two, Arbitrum has generated substantially more revenue, driven by its higher use. This indicates that, in terms of fundamental value of the rollup, Arbitrum has been more successful than Optimism thus far. However, it is worth noting that today’s revenue numbers make it difficult to justify the hefty valuations attached to ARB and OP. The market is likely pricing in a lot of growth into today’s FDVs, while also placing a premium on the current Ethereum scaling leaders.

Conclusion

Conclusion

Both Arbitrum and Optimism have carved distinct niches in the Layer 2 scaling landscape, each with its unique strengths, weaknesses, and general approaches to scaling Ethereum. Arbitrum appears to have made more significant strides in inheriting Ethereum's security with its active fraud proofs and robust governance model. On the other hand, Optimism, with its open-source MIT license, has been more successful in attracting rollup developers to build on its stack, helping to foster innovation. Both rollups still have substantial room to grow, particularly in the realm of upgradeability, to truly inherit Ethereum’s security to the fullest extent.

Arbitrum's approach has led to the creation of a more vibrant user ecosystem, as made evident by higher user engagement and transaction volume. This suggests that its strategy resonates well with users seeking the security and cost saving benefits of a rollup and appealing to dApp developers. Both platforms, with their respective focuses, contribute uniquely to the broader Ethereum ecosystem, driving forward the vision of a scalable, secure, and developer-friendly Ethereum.

Disclaimer

Matt Fiebach, the author of this report, sits on the Arbitrum Security Council and receives a monthly stipend in ARB tokens.

The information contained in this report and by Blockworks Inc. and related affiliates is for general informational purposes only and is not intended to provide legal, financial, or investment advice. The report should not be construed as an offer or solicitation to buy or sell any security, token, or financial instrument and does not represent any recommendation or endorsement of any investment or financial product or service. Blockworks Inc. and related affiliates are not registered as a securities broker-dealer or an investment advisor in any jurisdiction or country.